Seasonal Market Movement Could Be to Blame

As we all know, no one can predict market volatility. Any number of major or minor political, economic, social, or extraneous events can influence buy-ins or sell-offs in the market.[i]

Back in March of 2020, for example, as the Coronavirus swept the globe, the S&P 500 dove into a bear market almost overnight.[ii] But to the surprise of many, markets rebounded nearly as quickly as they plummeted.[iii] Stocks rallied once again in Q4, possibly fueled by news of a vaccine and the passage of a second stimulus package.[iv]

The hope is certainly that 2021 returns will be as lucrative as last year’s. Even amidst the many challenges and struggles of 2020, the S&P 500 Index rose 16%, the Dow jumped 7.25% and a tech-heavy Nasdaq tacked on a notable 44%.[v] Gold and silver also had their best years since 2010 with gold up +24.6% and silver up +47.6%. [vi]

A Resilient Start to 2021

Fast forward to the first week of 2021, and the markets seem to be holding strong despite political unrest and the resulting storm on Congress that occurred January 6th. [vii] At first, the outlook was grim. The S&P 500 fell from its highest point in the day only moments after the capitol was placed on lockdown; however, it ended the day with a gain of 0.6%.[viii] Perhaps investors believed this insurrection was “more of a blip than an indicator of long-term chaos,” as Eliza Carter of the Morning Brew reports.

Seasons of Volatility?

But despite the market’s present display of resilience, should we brace ourselves for volatility in Q1 of 2021? Is Q1 typically a season of volatility for the market?

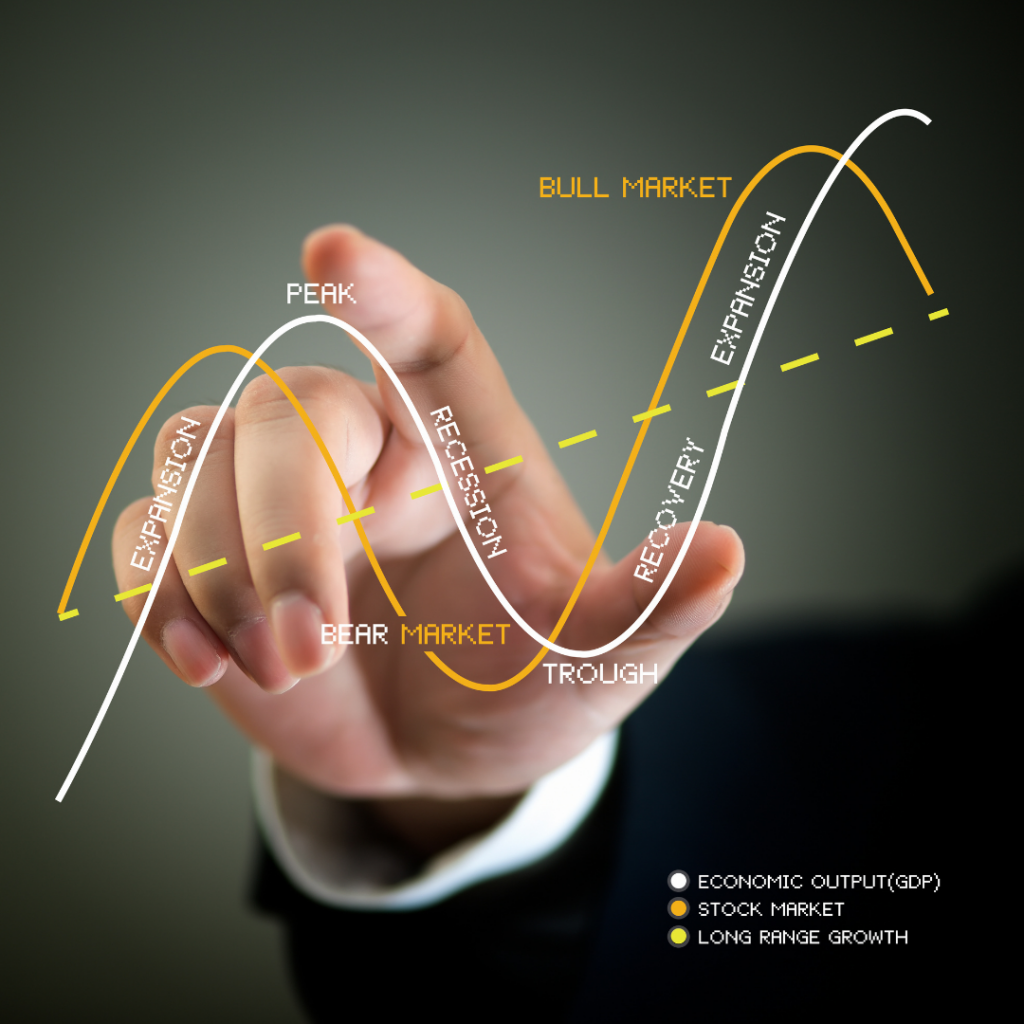

According to some analysts, there is seasonality to the stock market.[ix] This refers to the market repeating seasonal trends year over year. The beginning of the year, the end of the year and the summer months fall into some of these seasons.

The January Effect

The January effect refers to a trend that tends to occur between the last trading day of December through the fifth trading day of the year.[x] “Investors tend to sell losing stocks at the end of December so they can claim tax losses, and bargain hunters are then able to purchase the stocks at a discount. This new demand creates buying pressure on the market, which affects gains and losses,” according to Zacks Research. This being the case, Q1 performance may not always be an indicator of the year ahead—just take the 2020 example above as evidence.

Year- End

As we mentioned above, many investors typically take advantage of December to sell off losses for the purpose of offsetting capital gains tax before the year ends.[xi] This incurs a loss of demand that can result in notable fluctuations in the market. Many experts suggest investors perform a tune-up of their portfolios in October and then leave them well alone until the following year. This helps keep them from falling into the volatility trap and making premature moves resulting from potential fluctuations during the holiday season.

Summer Doldrums

The summer months are also known for being particularly volatile and historically have been referred to as the “summer doldrums.”[xii] The perception is that between July and Labor Day many investors are away on vacation and not heavily buying or selling. In theory then, liquidity is lower than it typically might be, so even small drips of trading activity in the pond could cause larger waves of movement than they typically would during the other months of the year.[xiii]

Seasonality Doesn’t Tell the Whole Story

However, do not rely on seasonality alone to inform your investment decisions. Simply because a pattern has existed in the past, does not mean it will continue in the future, especially in the wake of the COVID-19 pandemic. Seasonality should simply be one of the factors you consider in your research.

Always consult with your trusted financial advisor, or contact our URS Advisory office to schedule a complimentary initial conversation before making any major money moves. The decisions you make today can have long-lasting effects on your future.

[1] https://www.thebalance.com/how-market-prices-move-through-buying-and-selling-1031049 12 January 2021

[1] https://www.cnbc.com/2020/03/11/futures-are-steady-wednesday-night-after-dow-closes-in-bear-market-traders-await-trump.html 12 January 2021

[1] https://www.wsj.com/articles/why-did-stock-markets-rebound-from-covid-in-record-time-here-are-five-reasons-11600182704 12 January 2021

[1] https://www.investors.com/news/stock-market-rally-higher-on-stimulus-deal-hopes-bitcoin-soars-coronavirus-vaccine-rollout-begins/ 12 January 2021

[1] https://www.washingtonpost.com/business/2020/12/31/stock-market-record-2020/ 12 January 2021

[1] https://schiffgold.com/key-gold-news/gold-and-silver-chart-best-year-in-a-decade/ 12 January 2021

[1] https://www.nytimes.com/2021/01/06/business/stock-market-rally.html 12 January 2021

[1] Ibid.

[1] https://finance.zacks.com/seasonal-stock-market-trends-5830.html 12 January 2021

[1] Ibid.

[1] https://www.jstor.org/stable/2326911?seq=1 12 January 2021

[1] https://www.thebalance.com/what-are-the-summer-doldrums-357349 12 January 2021

[1] Ibid.