Will US Treasury Bonds still be considered “smart money” following the Fed’s debt monetization?

After a decade of slow and steady growth, 2020 came in with a bang. Thus far, it has been a year of ballooning federal debt and deficit spending primarily monetized by the Fed in response to the COVID-19 crisis.

This year, the Federal Reserve created new bank reserves in order to buy trillions of dollars worth of Treasury securities—a practice commonly known as debt monetization. In fact, from mid-March through mid-April of this year, the Fed accumulated more Treasuries than the entire foreign sector accumulated over the past 6 years.

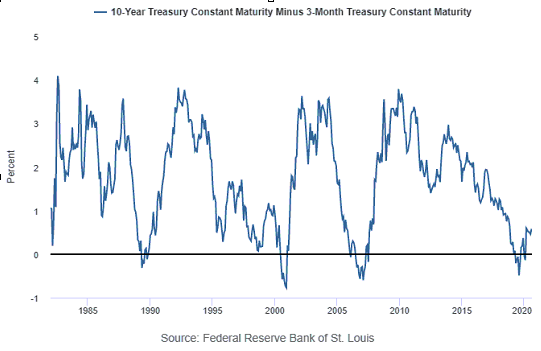

Now, to set the stage, flashback to the March of 2019 when the yield on the 10-year U.S. Treasury dipped below the yield on the 3-month U.S. Treasury for the first time since 2007. Historically, the 10-year minus 3-month inversion has been the canary in the coalmine for an impending recession (Figure 1) with ample lead-time following an inversion.

In these circumstances, we tend to see investors flock from the volatility of equity investments into the “safe harbors” of the bond market to ride out periods of anticipated slower economic growth and lower inflation. Essentially, investors have come to reference the yield curve or other moves in the bond market as potential leading indicators of what might happen to equities going forward.

Is this leading indicator still effective?

While this view of the bond market has historically been the case, the unusual circumstance with the Fed brings up some natural questions. What happens when the Federal Reserve intervenes so heavily in the Treasury market? Are Treasury yields even reliable indicators of performance if the Federal Reserve is the biggest buyer of Treasuries? What can investors do to benefit from or hedge against the potential outcome?

Of course, the concern is that the bond market could now become a wolf in sheep’s clothing—appearing to be the safe haven it has historically been, but not producing the returns needed to outpace inflation. This could potentially turn a “smart money move” into a losing money move by the time the bonds mature. And if this is the outcome, how long could it be before we could “trust” Treasuries as safe haven’s once again? Of course, these are all theoretical scenarios and are not advice to move to or away from the US Treasury bond market.

However, to ignore the Fed’s large intervention in the bond market would be remiss. Traditionally, the most prudent form of defense against such uncertain outcomes is making sure your portfolio is well diversified to preserve purchasing power over time.

If you would like to learn more about this and other financial topics, please contact your trusted advisor or schedule a call with the financial professionals at URS Advisory to learn more.

Disclaimer: Advisory services are offered through URS Advisory LLC, a Registered Investment Advisor in the State of Florida. Insurance products and services are offered through URS Insurance, an affiliated company. URS Advisory LLC and URS Insurance are not affiliated with or endorsed by the Social Security Administration or any government agency. Investing involves risk including the potential for loss, and past performance is no indication of future results. Opinions expressed herein are solely those of URS Advisory. All written content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions. Material presented is believed to be from reliable sources; however, we make no representations as to its accuracy or completeness. All information and ideas should be discussed in detail with your financial adviser or qualified professional before making any financial decisions.[i]https://www.fedweek.com/tsp/massive-deficits-and-historical-investment-implications/ 26 August 2020

[ii] https://www.cnbc.com/2019/08/14/the-inverted-yield-curve-explained-and-what-it-means-for-your-money.html 26 August 2020

[iii] https://www.cnbc.com/2019/08/28/yield-curve-inversion-not-just-a-recession-switch-bespoke-paul-hickey.html 26 August 2020