How many times have you heard someone say, “Wow! I really wish I had saved less for retirement!”?

We have certainly never heard it. That’s because amassing enough wealth to live comfortably in retirement is no simple feat. And plenty of times, folks are looking to enhance their quality of life as they age, as well, which may require more income. Whether you are retiring next year or in the next 10 to 20 years, planning now we believe is the key to success.

Retirement Planning Has Changed

It’s clear that this is no longer your father’s retirement. As is to be expected, the times have changed. Retirement planning has evolved over the past few decades in such a way that makes planning early even more critical. Not only do retirement and health care costs continue to rise, but people are living longer. Planning for a retirement that could last thirty years or longer leaves little room for error and no room for procrastination.

Building the retirement cushion you need can be a lot easier if you start at a young age. Why make retirement planning any harder than it has to be?

Retirement Costs More, the Longer You Wait to Save

Would you be surprised to learn that the longer you wait to prepare, the more your retirement will cost you?

Yes, you read that correctly. The same retirement will cost you more to fund the fewer years to have to save for it.

You see, everyone starts out in the same boat: with few assets and a whole lot of time. The trouble is, in investment terms, time is a wasting asset that loses value each day your money isn’t working for you.

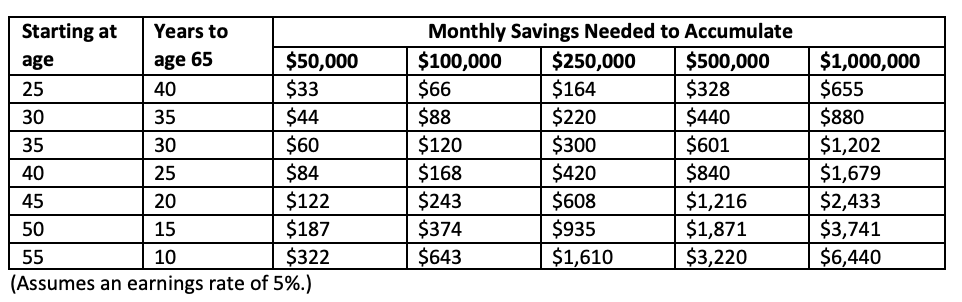

Consider the following chart:

As you can see, a 25-year-old wanting to retire at age 65 with a million dollars only has to save $655 a month. But, waiting until age 35 to start saving increases the cost by nearly 100%. And those who wait until age 45 to start saving can find themselves in an even deeper hole, having to save a larger portion of their income (or taking on more risk) to achieve the returns they’ll need. Often, it’s a mix of both!

Essentially, as the value of time wastes away, the cost of your retirement increases, making it more challenging to achieve your goal.

Why? The Power of Compounding

An amazing thing happens to your money as time passes: it grows! This is referred to as compounding. In simple terms, compounding is what happens when you earn money on re-invested investment earnings.

Here’s an example:

According to CNN Money, if you set aside $3,000 for 10 years every year from ages 25 to 35, never saving another dime, and earning a 7% annual return, you’ll wind up with $338,000 at age 65. Start saving at 35, socking $3,000 away every year to age 65, and you’d finish with less—$303,000.

This is also why it’s so important not to touch your retirement investments once they are contributed. Any time away from the market—or time your money isn’t invested—translates into lost growth potential. So, it’s best to stash it and forget it. Out of sight, out of mind—until you really need it in retirement, of course.

Plus, You’ll Save in Taxes

Whether you are planning for income generation in retirement or working on your tax strategy for this year, we believe the main goal should always be to reduce the overall lifetime tax bill.

You see, many retirement savings accounts offer tax savings benefits—some accounts offer tax savings benefits now, and others, later. The most popular retirement account option offered by employers is the 401k. The 401k account allows you to invest pre-tax dollars and defer paying taxes on them until retirement. That sounds great in the present, as it reduces your current liability, but can become a huge problem once you have to pay the tax bill in retirement when you are living on a fixed income.

Other accounts, like Roths, are funded with post-tax dollars, but offer tax-free withdrawals on earnings in retirement. Other options still, like HSAs, allow you to contribute pre-tax dollars and make tax-free withdrawals (when used for qualified expenses).

We feel the goal should be to generate income from all three tax treatments: (1) taxed, (2) tax-deferred, and (3) tax-free to supplement your social security benefits in the most tax-advantaged way possible. This will provide for the longevity of your wealth and ensure you don’t run out of money.

Plus, some of these strategies may not make sense if you are working on a truncated timeline. Or, at the very least, won’t be as powerful.

Start Early, Save Often, and Learn as Much as You Can

It’s never too early to start planning your retirement. The sooner you start, the less it will cost and the more successful you may be.

As you start planning, learn as much as you can about the process and ways you can save to increase your accumulated wealth and minimize taxes.

Ready to get started?

Join us for “Destination Retirement”—an exciting two-session educational course for adults in or nearing retirement where you will learn how to:

- Determine when you can retire

- Map out your ideal retirement scenario

- Optimize your cash flow and reduce debt

- Study different investment options

….and much more!

The event cost is $49 and advanced registration is required. You can learn more and sign up at www.URSLEARN.com using the corresponding codes below: Treasure Coast = 3URS2022 and Palm Beach Gardens = 4URS2022.